The Problem: Lansing Wastes Your Tax Dollars

Every year, Michigan residents send billions in state income tax to Lansing, where it is often mismanaged, wasted on bureaucracy, or spent on projects that do not benefit local communities. Instead of funding essential services, these tax dollars are funneled into bloated administrative costs, unnecessary studies, and political pet projects. For example, Lansing spends hundreds of millions on economic development programs that promise jobs but deliver little, while roads crumble and schools remain underfunded. Taxpayer money is also wasted on excessive government salaries, corporate subsidies totaling $600 million annually, and over-budget infrastructure projects, leaving communities struggling to make ends meet.

This wasteful spending is why property and state income taxes are so high, burdening homeowners and businesses alike. Even with these taxes, townships and counties are forced to request additional millages just to cover essential services like schools, jails, and local infrastructure. It doesn’t have to be this way. By demanding transparency, eliminating unnecessary expenditures, and returning power to local communities, Michigan can break free from this cycle of waste. Anthony Hudson is committed to fighting for lower taxes and smaller government, ensuring that your hard-earned dollars are invested where they matter most—right in your community.

The Solution: County-Controlled taxation

Instead of sending money to Lansing and hoping it comes back, Anthony will work to

eliminate property taxes and state income tax and replace them with a county tax,

controlled locally, to directly fund services that property tax and millages currently cover.

This means:

• No more property taxes—you own your home and land outright.

• No more sending income tax to Lansing to be wasted.

• Local governments have the money to build and improve their communities

without waiting on the state.

• Each county can determine the best tax structure based on its needs and

population.

• If a county does not generate enough tax revenue, the same state support

mechanisms that currently supplement property tax shortages would remain in

place.

County-by-County Example: More Money, More Local Benefits

Let’s look at different counties in Michigan and how local taxation would work:

High-income, high-population counties (Oakland, Kent) would generate more than enough revenue to fund top-tier schools, public safety, infrastructure, and community improvements without sending money to Lansing.

Low-income, low-population counties (Keweenaw) may need limited state support, just as they do now under the property tax system.

Low-income, high-population counties (Wayne) would see a significant benefit from retaining tax revenue locally rather than sending it to Lansing, where it is misused.

High-income, low-population counties (Leelanau) would thrive with localized control, making investments in community development, tourism, and public services. Because of their low population, they may need limited state support similar to Keweenaw.

What Local Governments Can Do with Their Own Tax Revenue

When tax dollars stay local, communities flourish. Counties, cities, townships, and

villages would have the funds to:

• Develop vibrant downtown districts with thriving businesses and cultural

attractions.

• Build parks, bike paths, and outdoor recreation areas that attract residents

and visitors.

• Invest in top-quality schools, libraries, and public safety to create safe and

educated communities.

• Fund community-driven projects like water parks, outdoor theaters, and

beautification efforts.

• Upgrade and expand infrastructure to support growth and economic

prosperity.

• Ensure humane and efficient jails while maintaining law and order.

• Boost property values as desirable communities emerge, increasing wealth

and stability.

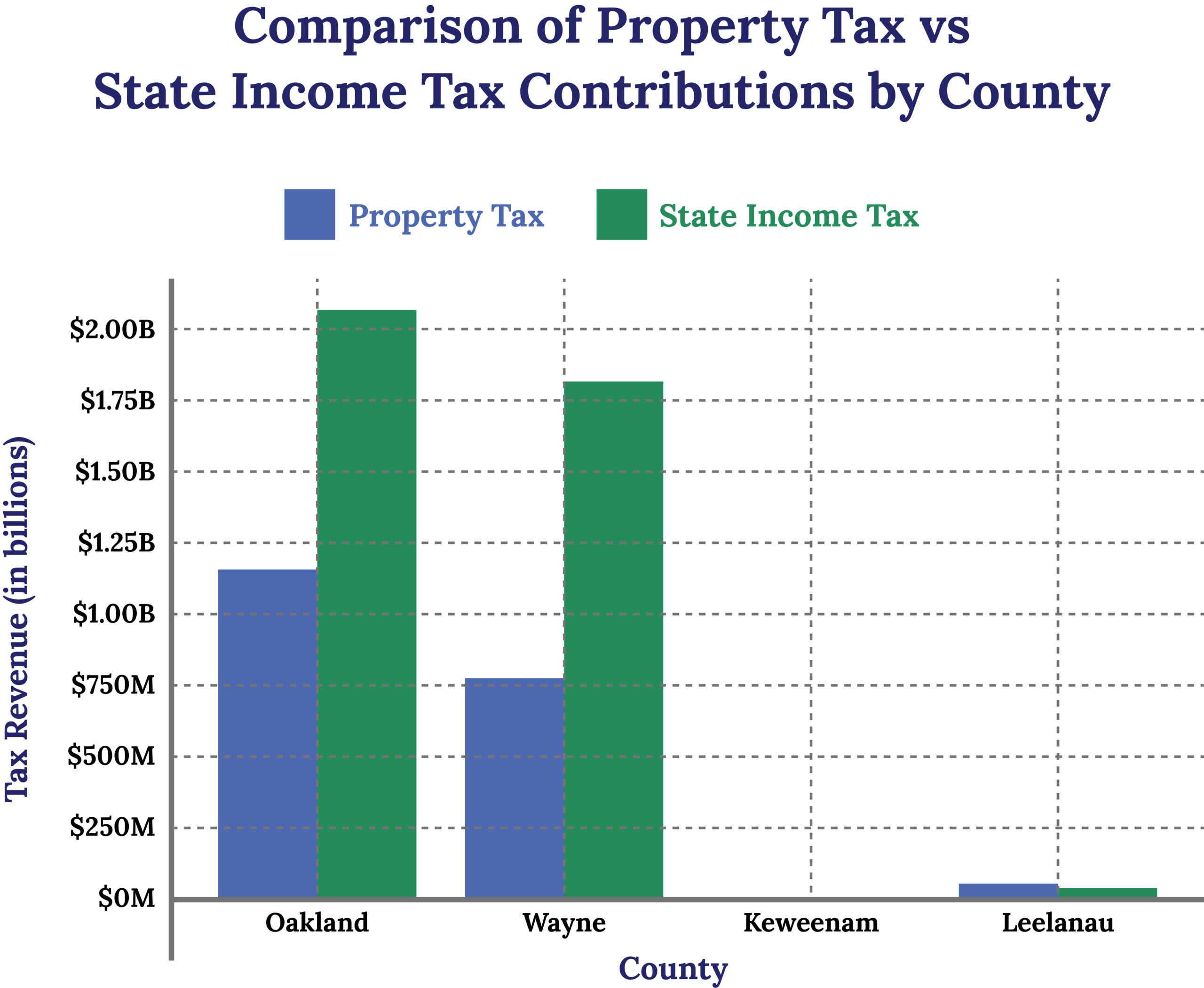

Data & Visuals

Below are charts illustrating the financial impact of eliminating property and state income taxes while implementing a county tax system for the following four counties who represent diverse scenarios, as follows:

Most Income, Most Populated

Oakland County – One of the wealthiest counties in Michigan, with high median household incomes and affluent suburbs like Bloomfield Hills and Birmingham. It is also one of the most populated counties (over 1.2 million people).

Least Income, Least Populated:

Keweenaw County – The least populated county in Michigan (under 2,500 people) and has a low median household income. Located in the Upper Peninsula, it has a small economy and limited job opportunities.

Most Income, Least Populated:

Leelanau County – A small, rural county with a high median income due to tourism, retirees, and wealthy seasonal residents. As one of the least

Least Income, Most Populated:

Wayne County – The most populated county in Michigan (over 1.7 million people), but Detroit’s economic struggles bring down the median household income significantly. Many areas have high poverty rates.

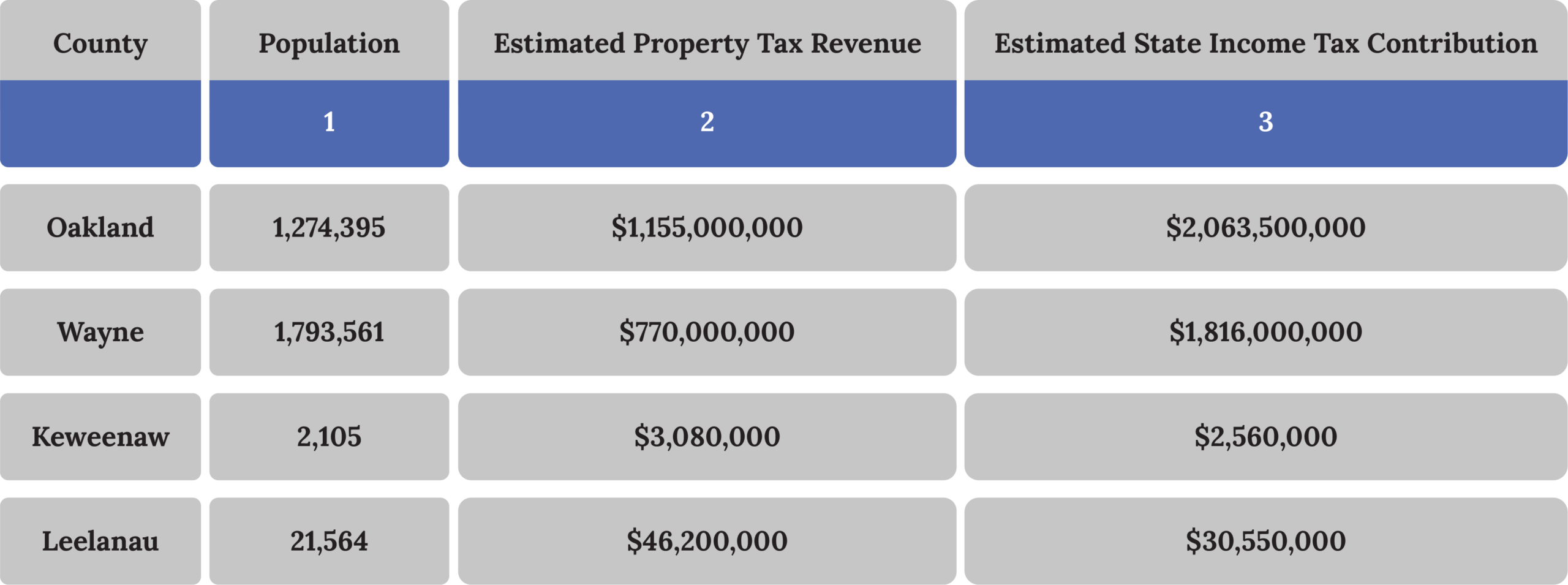

County Tax Revenue vs. Property and State Income taxes

Summary of the Population, Estimated Property Tax Revenue, and State Income Tax Contributions for Oakland, Wayne, Keweenaw and Leelanau Counties

Sources & Notes

Population Data [1]: Sourced from recent U.S. Census estimates.

Property Tax Estimates [2]: Based on the Michigan State Tax Commission’s 2023 Annual

Report for State Equalized Valuations (SEV) and applying an average property tax rate of 1.54%.

Formula: Estimated Property Tax = SEV × 1.54%

State Income Tax Estimates [3]: Based on per capita income estimates and Michigan’s state

income tax rate of 4.05%. Formula:

Estimated Income Tax = (Population × Per Capita Income) × 4.05%

Per capita income approximations are based on regional economic data.

The Vision: A Future Without Property Taxes & Lansing Waste

Imagine a Michigan where you truly own your home, without the constant fear of property tax foreclosure. Picture local governments fully funded and empowered to create strong, beautiful, and prosperous communities—without waiting for handouts from the state. Visualize townships no longer struggling for millages to fix jails or fund basic services, because they already have the money right where it belongs—in the community.

Instead of sending billions to Lansing to be squandered, that money stays where it matters most: in your county, your city, your township—building a future that works for you.

It’s time for Michigan to eliminate property taxes and state income tax and replace them with a smarter, fairer, county-based tax system that puts the power and money back in the hands of the people.